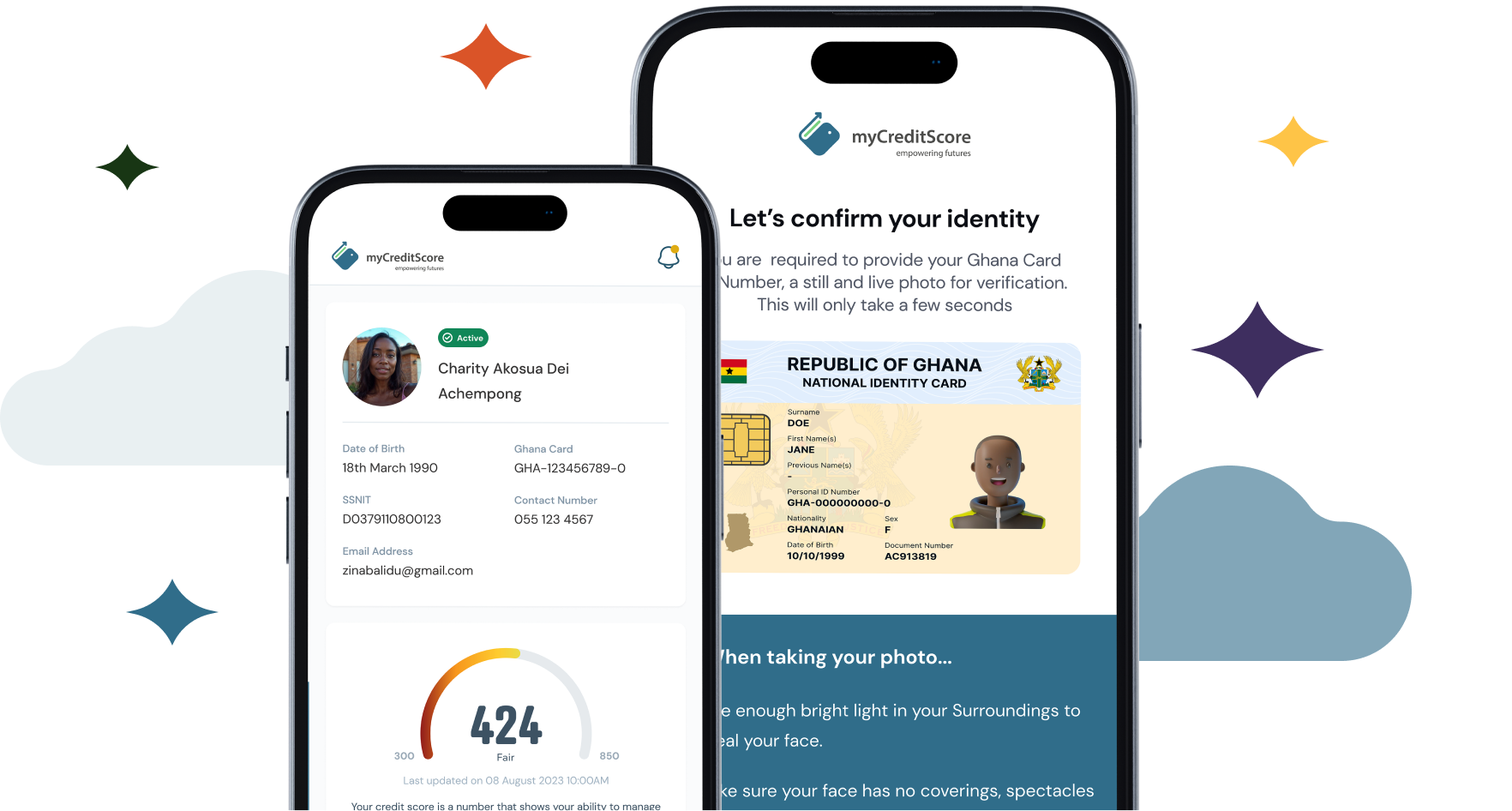

Understanding Credit Score: The New Financial Passport to Accessing Loans in Ghana

June 18, 20255 minutes read

What exactly is a credit score?

A credit score is simply a three-digit number that reflects how trustworthy you are when it comes to repaying debt. Think of it as your financial reputation.

In everyday life, people naturally evaluate each other’s borrowing behaviour. If you’ve ever refused to lend money again because someone never paid you back, then you’ve done your own version of credit scoring.

Now imagine this on a national or global scale. That is what credit scores do for banks, lenders, and utility companies.

From the 1950s to Today

Credit scoring started in the 1950s when Bill Fair and Earl Isaac created the FICO system. Since then, the process has become far more advanced.

It has moved beyond simple credit history to include mobile money transactions, utility bill payments, and e-commerce behaviour.

READ ALSO: The Evolution of Credit Scoring in Ghana

Ghana’s Digital Leap

Traditionally, lenders evaluated borrowers using the three Cs: Character, Capacity and Capital.

But platforms like myCredit Score in Ghana are redefining the game by using digital data sources:

• Mobile money usage

• Utility and telecom payment history

• Ecommerce and digital transactions

By tapping into these data points, myCredit Score offers a more accurate and inclusive approach.

According to GSMA’s 2023 report, over 621 million people in Sub-Saharan Africa use mobile money and Ghana alone contributes more than 22 million users.

The Economic Ripple Effect

Strong credit scoring offers more than just loan access. It builds financial trust Risk reduction for lenders is real.

Countries with solid credit systems experience fewer non-performing loans and IMF research shows scoring can reduce defaults by 20 to 30 percent In Ghana my Credit Score’s pilot recorded a default rate of just 2.51 percent significantly lower than traditional systems.

Financial inclusion is improved too According to World Bank Global Findex data formal credit access rises by as much as 30 percent when credit scoring improves and CGIAR research reports that alternative data systems can make up to 50 percent more people eligible for loans.

A good credit score leads to better job opportunities, lower interest rates on mortgages, and more access to business capital.

Real-life Impact

Aisha is a market trader in Accra who ran her business in cash for years. Her mobile money records and supplier payments earned her a GHS 20,000 loan, which she used to open a second shop and hire two employees.

Kwame is a teacher in Kumasi who had been denied a mortgage despite steady income. His utility payments and mobile money behaviour improved his score enough to secure a better interest rate

Sarah is a tech entrepreneur in Accra whose startup was too young for traditional funding. myCredit Score used her digital transaction history to help her secure GHS 150,000 in growth capital

Numbers Don’t Lie

From the myCredit Score pilot

• Loans disbursed 40,791

• Total value GHS 637,799.82

• Default rate 2.51%

• Non-performing loan rate: 3.44%

• Average processing time: 24 hours

Community Level Impact

In the Volta Region, a group of 15 women used their collective repayment record to access a bigger loan now they mentor other women’s groups.

In the Northern Region, 30 smallholder farmers lowered interest rates from 100% to 25% by using formal credit scores instead of informal lenders.

At the University of Ghana, 5000 students participated in programs showing how mobile money behaviour can shape financial futures.

The Tech Behind the Change

Artificial intelligence and machine learning improve scoring accuracy and reduce false negatives.

Blockchain-based systems are being tested to cut scoring costs by up to 70 percent. Decentralized finance platforms may serve unbanked populations globally.

Regulation And Data Privacy

Ghana follows global best practices for user data protection, and the Bank of Ghana has clear laws for credit bureau operations.

What’s Next? The Future of Credit Scoring in Ghana

Real-time scoring is already here. myCredit Score updates scores continuously using live data.

ESG integration (Environmental, Social, and Governance factors) is slowly being added to scoring models, especially as lenders start looking beyond just financial behaviour to include impact and sustainability.

Gig economy credit scoring, green business loans, and smartphone-based microloans are all on the horizon.

READ ALSO: How myCredit Score Is Reducing Loan Defaults in Ghana

Know Your Financial Story

A good credit score is more than just a number. It’s your financial passport. It’s how the world begins to take you seriously.

Whether you’re a market trader, a teacher, a student, or a startup founder, your daily financial habits are shaping your future access to credit.

The earlier you understand your score and how to build it, the better your chances of creating long-term opportunities for yourself, your family, and your business. In this new economy, your credit score is becoming just as important as your ID.