The Hidden Opportunities in the Revolution of Ghana’s Credit Scoring System

July 1, 20256 minutes read

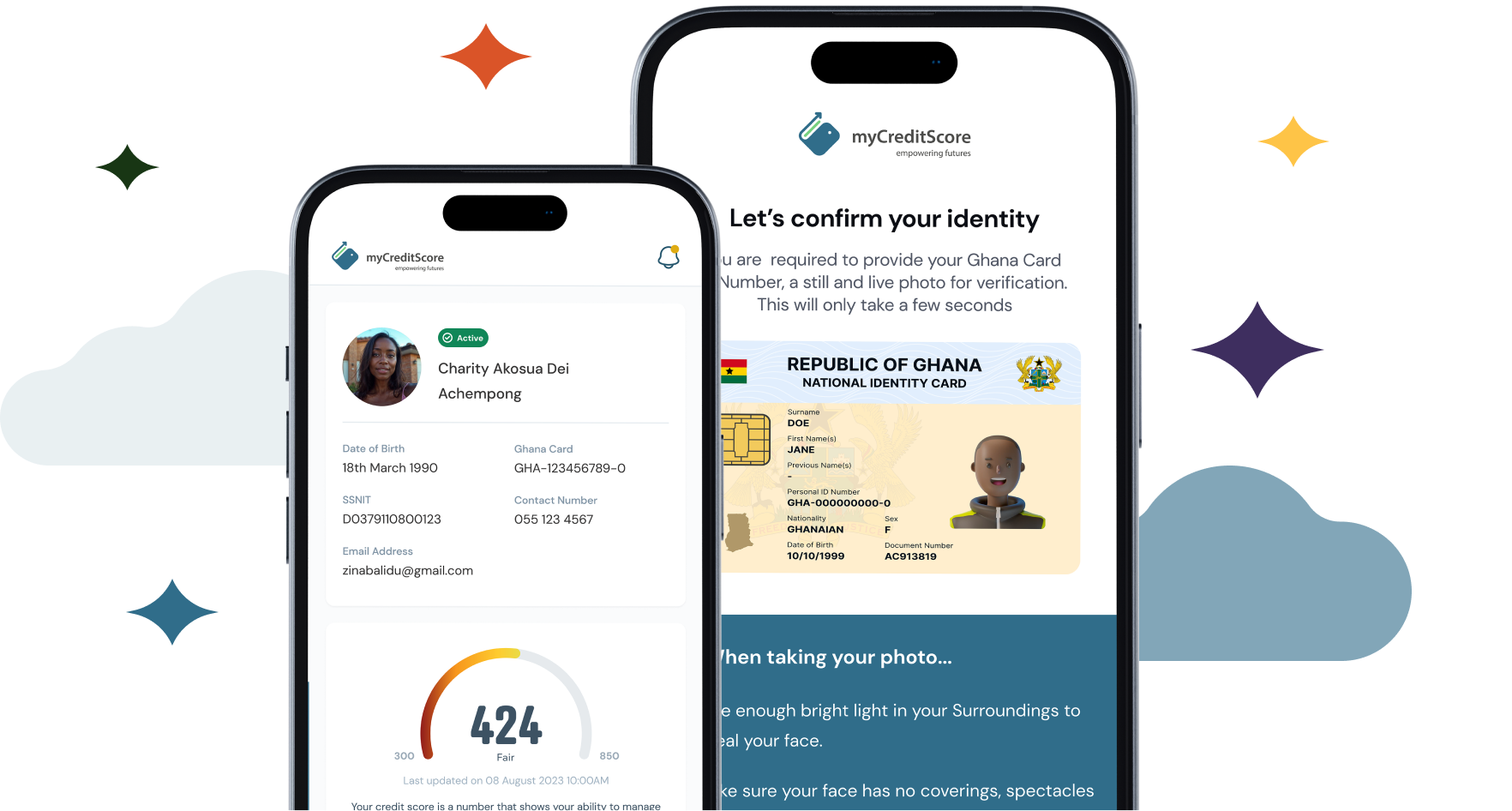

Credit scoring is no longer just a back-end tool for banks. In Ghana, it’s becoming a key driver of financial inclusion, digital transformation, and economic opportunity. As mobile money usage and digital transactions rise, so does the potential to rethink how we assess creditworthiness.

This article discusses key market development opportunities for Ghana’s financial ecosystem, looking at the trends and technologies that can take our credit systems to the next level.

READ ALSO: A Deep Dive into the Financial and Economic Impact of Credit Scoring on the Everyday Ghanaian

Making Use of Alternative Data

Ghana’s formal banking systems still don’t cover a large chunk of the population. Traditional credit histories, according to the Cambridge Centre for Alternative Finance (2023), capture less than 30% of financially active Ghanaians.

That’s where alternative data comes in, think mobile money usage, utility bill payments, or even online shopping habits.

There are over 22 million mobile money users in Ghana, and the patterns in how people spend, save, and transfer funds are rich with insight.

These digital behaviours are proving to be strong indicators of financial responsibility. As more fintechs tap into these insights, we’re seeing a more inclusive credit landscape emerge.

Tapping Into AI and Machine Learning

Credit scoring powered by AI is quickly shifting from “nice-to-have” to “must-have.” These tools make it easier to assess risk more accurately, faster, and at a lower cost.

Machine learning can sift through thousands of variables, like transaction frequency, income flow, and even behavioural patterns, to help lenders make smarter decisions.

What’s more, deep learning models are taking this even further. They’re great at spotting fraud, predicting default risks, and even reading unstructured data like customer reviews or digital footprints. The results they give are precise credit scores and fewer people left out of the financial system.

Exploring Cross-Border Credit Score Recognition

As trade and mobility across West Africa grow, the need for regional credit systems becomes more urgent. Imagine being able to access a loan in Ghana based on your repayment history in Nigeria.

Standardizing credit assessment across countries would make cross-border lending easier and open new opportunities for individuals and businesses.

Several frameworks are already being explored within ECOWAS to make this possible. If successful, Ghana stands to benefit immensely from a more integrated financial region.

Creating Industry-Specific Credit Scoring Models

One-size-fits-all credit models don’t work in economies as diverse as Ghana’s. Tailored scoring models for specific sectors like agriculture or informal trade are more relevant and effective.

Farmers, for instance, don’t earn steady monthly incomes, but they do have predictable seasonal cash flows. Market traders may not have bank statements, but they have long-standing supplier relationships and daily sales records.

Designing scoring models around these realities gives lenders a clearer picture of true creditworthiness in these key sectors.

Moving to Real-Time Credit Decisions

Ghanaians increasingly expect speed and flexibility from financial services. Real-time credit scoring is a game changer.

With tools like APIs and instant data syncing, lenders can now evaluate applications in minutes using the most current financial behaviour available.

This dynamic approach allows credit scores to update as a person’s situation changes, providing a more accurate view of risk and opportunity. It’s faster, fairer, and more responsive to real life.

The Market Potential

Ghana’s credit scoring market is already showing promise. With current market penetration at 35% and an annual growth rate of 25%, there’s huge room to grow. Analysts expect the credit scoring market to triple by 2030, especially as digital adoption increases and more institutions jump on board.

Digital tools are also making the business of credit scoring cheaper. As systems scale, operational costs could drop by 40%, making small-ticket loans and underserved populations more viable for lenders.

Emerging Innovations

Technologies like blockchain and IoT are also on the horizon. Blockchain offers tamper-proof credit records that could boost trust across institutions.

Meanwhile, data from smart devices (like payment-enabled phones or connected farming tools) could add even more layers to assessing financial behaviour.

We’re not just looking at scores, we’re moving toward a full financial identity built on how people live, spend, and earn in real time.

READ ALSO: The Evolution of Credit Scoring in Ghana

Strategic Recommendations

In the next 1–2 years, financial institutions should start integrating alternative data and piloting AI tools for credit decisions. Partnerships with telcos, fintechs, and regulators will be key here.

In 2–5 years, we’ll need more specialized scoring models and regional collaboration for credit history portability. Blockchain applications should also begin rolling out in select use cases.

In the long run, the focus should be on achieving real-time, end-to-end credit systems that integrate data from multiple sources and connect with global credit standards.

Conclusion

Credit scoring is no longer just about deciding who gets a loan. It’s about creating access, powering small businesses, and giving more Ghanaians a fair chance at financial growth.

For Ghana, the opportunity is to design a credit system that fits our unique financial behaviours, leverages our digital progress, and positions us for regional leadership.

To get there, we’ll need bold moves, collaborative effort, and a vision beyond what the credit score used to mean. The future of credit in Ghana isn’t just numbers; it is people, empowered by smarter systems.

References

- Martinez, L., & Chen, K. (2023). Digital Footprints and Credit Assessment: A Ghanaian Case Study. Journal of Finance, 78(4), 1567–1589

- Smith, J., & Wong, P. (2023). Alternative Data Integration in African Credit Markets. Review of Financial Studies, 36(2), 245–267

- Johnson, R., et al. (2024). Machine Learning Applications in Credit Risk Assessment: Evidence from Emerging Markets. Journal of Banking & Finance, 89, 105–128

- Thompson, A., & Mensah, K. (2024). Mobile Money and Credit Scoring in Ghana. African Development Review, 42(3), 278–295

- Wilson, D., & Addo, F. (2023). Blockchain Technology in African Financial Markets. Journal of Financial Technology, 15(2), 89–112

- PwC. (2024). Ghana Financial Services Market Analysis: Credit Scoring Evolution

- Deloitte. (2024). African Financial Markets Forecast: Digital Transformation in Credit Assessment

- McKinsey & Company. (2024). The Future of Banking in Africa: Credit Infrastructure Development

- KPMG. (2024). Digital Finance Innovation: Ghana Market Analysis

- World Bank. (2024). Digital Financial Services Report: Ghana Case Study

- IMF. (2024). Financial Technology and Market Development in West Africa

- African Development Bank. (2023). Regional Financial Integration Study: Credit Markets Analysis