The Evolution of Credit Scoring in Ghana

June 18, 20257 minutes read

Before You Ask for That Loan, Read This

When a loan officer at the local bank asks, “What’s the score?” they’re referring to a loan applicant’s credit score not the latest Black Stars match.

A credit score is a statistical measure that predicts the likelihood of loan default or late payment. Although credit scoring arrived later in Africa than in Western markets, it has rapidly reshaped lending across the continent.

In Ghana, with its growing middle class and vibrant business scene in Accra and Kumasi, credit scoring presents both opportunities and challenges as the country moves from cash-based transactions to data-driven lending.

READ ALSO: How myCredit Score Is Reducing Loan Defaults in Ghana

What is Credit Scoring in the African Context

African credit scoring systems have evolved differently, adapting to limited formal credit histories. In Ghana fewer than 25 percent of adults had formal credit files in 2023, according to the Ghana Credit Reference Bureau Association.

To address this, modern models pull from alternative data like mobile money transactions from MTN Mobile Money or Telecel Cash, telecom usage for airtime and calls, expressPay and Hubtel payments, agricultural harvest data, SSNIT contributions, merchant sales via Hubtel, Paystack or Flutterwave, and even psychometric tests measuring financial discipline.

For example, Bloom Impact in Kumasi uses mobile money data and business registrations to score micro-entrepreneurs with 31 percent higher accuracy than older methods.

Typical Ghanaian systems combine limited bureau data with mobile money history, telecom behaviour, business registration status, social references, and for farmers, seasonal patterns and crop diversity.

The Bank of Ghana’s 2022 digital lending regulations now support these tools while protecting consumers.

Where is Credit Scoring Used in Africa with Focus on Ghana

Consumer lending has been transformed by local credit bureaus XDS Data Ghana and Dun & Bradstreet. Together they score about 4.5 million Ghanaians or 25 percent of adults, compared to just 5 percent in 2015.

Mobile-based lenders such as Letshego Ghana’s Qwikloan, integrated with MTN Mobile Money, offer instant loans up to GHS 2 000 using algorithmic scoring based on transaction behaviour. Over 1.2 million Ghanaians use that service.

Home financing is changing too. Ghana Home Loans combines income data with diaspora remittance consistency and incremental build patterns common in Ghanaian housing to boost mortgage approval rates by 28 percent since 2021.

GREDA and Ecobank use tools that evaluate formal and informal income sources for buyers in developments like Appolonia City.

For MSMEs, fintechs like Nokwary in Accra analyse WhatsApp and USSD transactions to assess small business viability and offer loans from GHS 1,000 to 10,000 in under 30 minutes.

Big banks like GCB and NIB include transaction and business registration data in their SME loan scoring. Farmerline’s Mergdata platform combines GPS-verified land sizes, crop yields, and farming practices to lend inputs to over 70,000 cocoa and maize farmers in Western and Ashanti regions.

Trade finance platforms such as Jetstream Africa analyse customs data, contracts, and shipment records to provide working capital loans averaging GHS 120,000 for shea butter and cocoa exporters.

New embedded finance products are emerging too. M-KOPA in Ghana offers salaried credit for solar systems and smartphones based on mobile transaction consistency.

Jamii Africa offers micro-health insurance and payment plans based on digital history at clinics like Nyaho Medical Centre. LEAP Africa’s student loans consider academic performance, guardian finances and career potential to lend to over 1200 students at Ghanaian universities.

Benefits of Credit Scoring in the Ghanaian and African Context

The shift has increased financial inclusion in Ghana from 8 to 27 percent of adults with formal credit access between 2015 and 2023.

Dashable has provided starter loans of GHS 50 through mobile apps to traders in Takoradi and Tamale, 80 percent of whom had never accessed formal credit.

Microentrepreneurs in Accra who used digital scoring saw incomes increase by 32 percent over 18 months compared to those without access.

Digital lending in Ghana reduced origination costs by 85 percent and enabled lending at smaller ticket sizes. Cal Bank reduced its average cost per small business loan from GHS 1200 in 2018 to GHS 230 by 2023.

Fidelity Bank now approves loans in under five minutes using mobile scoring versus an average of three to five business days.

Culture matters too. ADVANCE Ghana scored farmers by evaluating seasonal income patterns, community reputation and drought resilience, while Peoples Pension Trust scored informal workers on pension contribution consistency.

Both approaches reduced default rates when compared to standard individual scoring.

Credit scores are being used as education tools via programs like MTN Ghana’s YellowCredit, where score visibility improved bill payments by 64 percent and savings by 41 percent.

Challenges and Concerns in the Ghanaian Context

Data and infrastructure issues remain. Electricity outages in northern regions and parts of Volta Region disrupt digital record collection.

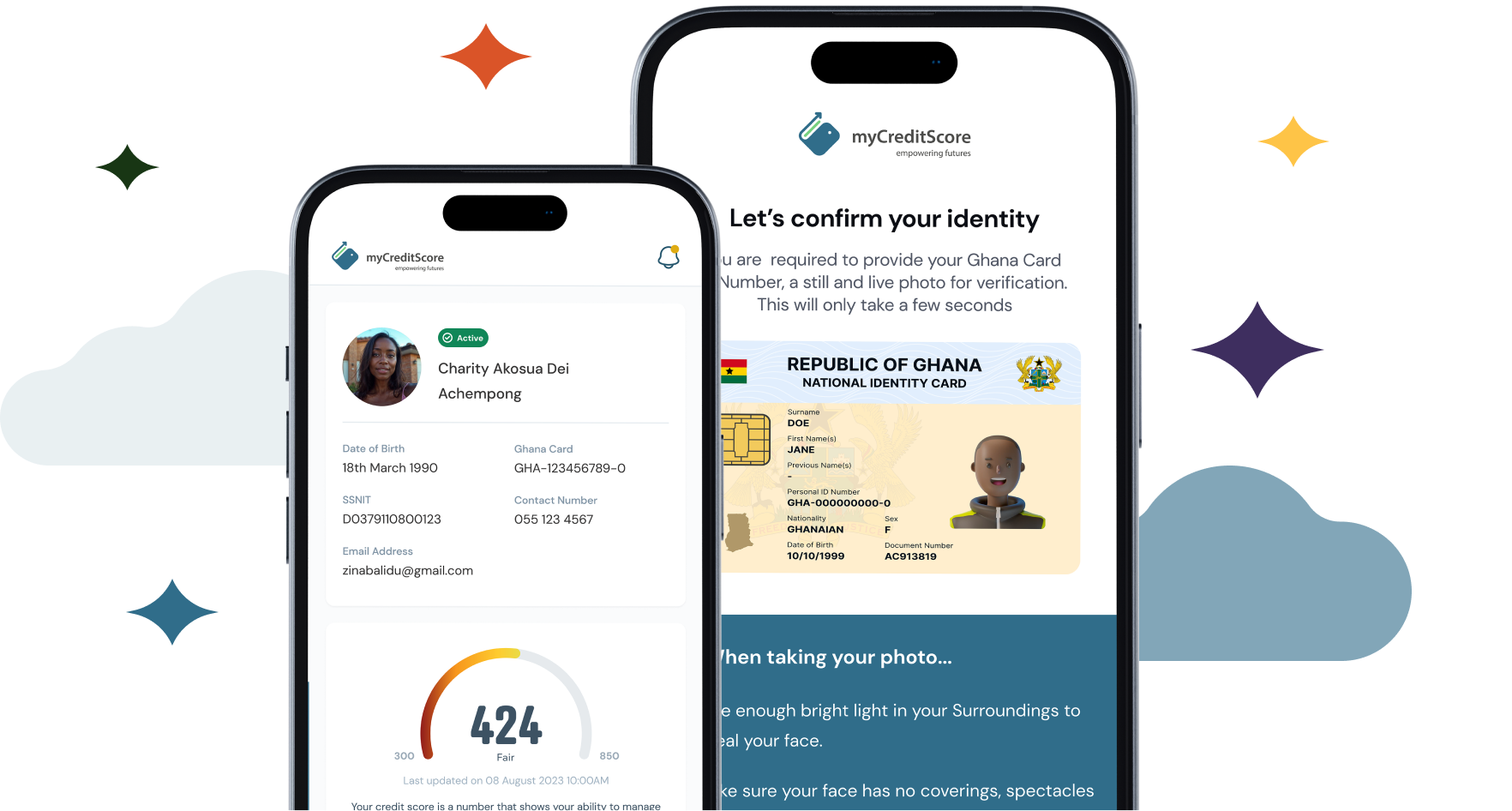

37 percent of Ghanaians report weekly connectivity issues. Ghana Card coverage is over 85 percent but integration into financial systems is incomplete. Identity failures still reject about 18 percent of applications.

Informal group saving traditions like susu can conflict with individual models. To bridge that gap Sinapi Aba Savings and Loans include social collateral from groups around Tamale and Wa, reducing default rates by 42 percent compared to individual scoring.

Regulations are evolving after reports of abusive practices like platforms accessing phone contacts and threatening families over nonpayment.

In 2023 the Bank of Ghana banned such behaviour and required explicit consumer consent. The Consumer Protection Agency opened a fintech complaints unit that handled 3 200 cases last year, 47 percent linked to digital lending.

Economic instability in 2022 with a 30 percent currency drop and 54.1 percent inflation challenged models. ABSA Bank had to recalibrate after defaults jumped from 4.7 to 12.3 percent, and now include macro stability indicators in their scoring.

Financial literacy remains a hurdle. Smartphone usage is at 44 percent and programs like Opportunity International Savings and Loans trained 75 000 rural users. Those who completed training understood digital credit terms better by 52 percent and defaulted 37 percent less.

Implications for Ghana’s Financial Sector

Traditional banks face disruption from mobile lenders. Jumo, partnered with MTN, approved 85 000 loans in 2023 without any physical branches.

Standard Chartered reports 73 percent of their loans are now initiated digitally through automated scoring and they have closed seven branches as a result. ADB now combines digital scoring with field reports to maintain rural outreach.

Partnerships are scaling too. Stanbic and Bayport offer preapproved loans with payroll data via USSD. Consolidated Bank Ghana recovered GHS 287 million in bad debt by rescoring borrowers and offering tailored restructuring options.

Standardized scoring is enabling secondary credit markets. Ghana Fixed Income Market saw 15 percent of private debt placements backed by scored loans in 2023.

Ghana Home Loans issued a GHS 260 million asset backed security backed by mortgage pools. COVID recovery financing through Ghana CARES saw a 92 percent repayment rate in 2023 compared to historical rates of 65 to 70 percent.

The Future of Credit Scoring in Ghana and Africa

Greater Ghana Card integration is planned for late 2025, potentially reducing identity fraud by up to 90 percent.

ECOWAS is building a regional credit information framework for cross border credit scoring, benefiting traders in border towns like Aflao and Elubo.

Climate resilience measures are being added to scoring for coastal fishers and northern farmers. The Bank of Ghana’s e-Cedi pilot has shown transaction data can improve risk assessments by 28 percent over traditional models.

Take Charge of Your Financial Story

Credit scoring in Ghana combines global best practices with homegrown innovation. From Accra’s tech hubs to Western Region cocoa farms credit scores are opening opportunities by recognizing real world behaviours.

Whether you’re a trader farmer student or entrepreneur your daily financial habits matter. Understanding how your score is built and how to improve it promises access to loans jobs housing and a brighter future.