The Borrowers Who Keep Ghana’s Credit System Alive – And What They All Have in Common

August 25, 20258 minutes read

Based on May 2025 Performing Borrower Analysis

While headlines often focus on loan defaulters, collapsing repayment rates, and the fragility of Ghana’s credit market, there’s a far less talked-about truth keeping the entire financial system upright: the borrowers who are actually doing everything right.

Each month, more than 2.3 million Ghanaians repay their loans on time. Quietly, consistently, and without drama, these individuals are upholding the very trust that credit systems are built on.

They’re not just borrowers, they’re the backbone of profitability for lenders, the proof that responsible lending can work, and the reason the system hasn’t already crumbled under the weight of default risk.

And yet, for all their value, these borrowers are rarely studied, rarely celebrated, and even more rarely understood in depth. Who are they? What makes them different? How do their lives, incomes, habits, and choices set them apart from defaulters?

And if they’re so valuable, why aren’t lenders doing more to find and serve more people just like them?

To answer these questions, we turn to the data from May 2025 a rich, detailed snapshot of Ghana’s most reliable borrowers.

REAL ALSO: Ghana’s Credit Market Is Exploding; Here’s Where the Money (and Risk) Is

What it reveals isn’t just a feel-good story of repayment—it’s a roadmap for smarter lending, better customer targeting, and sustainable growth in a market that desperately needs stability.

Let’s meet the people who make Ghana’s credit system work.

1. The 2.36 Million Money-Makers: Your Profit Reality Check

| Metric | Value | “So-What” in One Sentence |

| Total performing borrowers | 2.36 M | Three out of five borrowers pay on time – this is where your money actually comes from. |

| Performance rate | 59.2% | The majority of your portfolio works – now you need to clone these customers. |

| Average monthly income | GHS 4,997 | 2.7x higher than defaulters – income verification isn’t optional, it’s everything. |

| Average facility amount | GHS 20,104 | 10.8x larger than defaulter loans – bigger loans from better customers = sustainable profits. |

| Gender split (performers) | 59% ♂ / 41% ♀ | Male dominance among performers vs gender parity in defaults – acquisition strategy gap. |

| Teacher concentration | 12.1% | One in eight performing borrowers is a teacher -public sector = predictable payments. |

2. The Profit Makers: Who’s Actually Paying

A. “Teacher’s Pet Portfolio” (12.1% of performers, 90,112 customers)

| Trait | Data Point | Interpretation |

| Occupation dominance | 12.1% of all performers | Stable government employment = predictable cash flow = loan officer’s dream. |

| Performance correlation | vs 2.5% of defaulters | Teachers default at 1/5th the rate – this is your model customer profile. |

| Income predictability | Monthly salary | No seasonal volatility, no business risk, guaranteed payment dates. |

| Expansion potential | 200,000+ teachers in Ghana | Massive untapped market with pre-qualified risk profile. |

| Product fit | Salary-backed lending | Perfect match for payroll deduction products and longer-term facilities. |

Key opportunity: Teachers represent your lowest-risk, highest-volume expansion opportunity. Build everything around this segment.

B. “Income Sweet Spot Segment” (24.8% of performers, GHS 3,000-4,999 income)

| Trait | Data Point | Interpretation |

| Portfolio concentration | 24.8% of performers | This income bracket is your profit center—focus all acquisition here. |

| Loan-to-income ratio | 4.2x | Sustainable borrowing ratios without stress indicators. |

| Average facility size | GHS 16,069 | Large enough for meaningful profit margins, small enough for manageable risk. |

| Default correlation | Low risk indicators | This segment combines volume with quality – the holy grail. |

Key opportunity: This is your acquisition sweet spot. Every marketing dollar should target this income bracket.

C. “Marriage Premium Customers” (59.4% of performers)

| Trait | Data Point | Interpretation |

| Marital status advantage | 59.4% married | vs 34.3% married defaulters -marriage = stability = creditworthiness. |

| Risk profile | Significantly lower | Dual incomes, family stability, social pressure to repay. |

| Family demographics | Household decision makers | Borrowing for family investments, not personal consumption. |

| Lifetime value | Higher retention | Married customers stay longer, borrow more, default less. |

3. Performance Behaviour Decoded: What Success Looks Like

- “Higher Income = Higher Performance” Law

Performers average GHS 4,997 monthly income vs defaulters at GHS 1,850. Income isn’t just correlated with performance—it’s the primary predictor.

- Occupation Risk Hierarchy = 4 clear tiers:

- Government employees (Teachers, Military, Nurses): Ultra-low risk, predictable income

- Professionals (Admin, Healthcare): Moderate risk, stable employment

- Traders/Commerce (8.9% of performers): Higher risk but manageable with proper structuring

- Pensioners (3.3% of performers): Fixed income, excellent payment discipline

- Geographic Concentration = Opportunity Map

Accra (23.9%), Tamale (10.0%), Kumasi (9.6%) represent 43.5% of performers. Urban concentration = infrastructure advantage.

- Product Mix Success Pattern

non-secured loans (56.8%) + Term loans (33.6%) = 90.4% of performing portfolio. Simple products work better than complex ones.

4. The Million-Cedi Questions (And How to Answer Them)

| Question | Why It Matters | Starter Idea |

| Can we clone the teacher segment across other government sectors? | Teachers are 12.1% of performers vs 2.5% of defaulters – this pattern should work for all government employees. | Launch “Public Sector Plus” products for nurses, military, civil servants with teacher-like terms. |

| Why are we under-serving women when they represent 41% of performers? | Male skew in performers suggests acquisition gap, not performance gap – women pay but we’re not targeting them. | Create women-focused marketing campaigns and products targeting female government employees. |

| How do we scale the GHS 3,000-4,999 income sweet spot? | This bracket is 24.8% of performers with 4.2x income ratios – perfect profitability zone. | Build entire acquisition strategy around this income band with targeted marketing and simplified approval. |

| Can we predict future performers from current data patterns? | Income + occupation + marital status predict performance better than credit scores. | Weight government employment, marriage status, and GHS 3K+ income heavily in approval algorithms. |

| What’s the real profit margin on performing vs defaulting customers? | Performers have 10.8x larger average loans with zero default costs – this is where all profit comes from. | Calculate true customer lifetime value and shift all resources toward performer acquisition. |

5. The Big 5: Where the Real Money Is (Being Made)

- Government Employee Gold Mine – Teachers alone are 12.1% of performers. Scale this across all government sectors for guaranteed growth.

- Income Verification Advantage – GHS 4,997 average income vs GHS 1,850 for defaulters. Income verification is your most powerful underwriting tool.

- Marriage Premium Pricing – 59.4% of performers are married vs 34.3% of defaulters. Marital status should drive pricing and approval decisions.

- Urban Infrastructure Leverage – 43.5% of performers in top 3 cities. Urban concentration = operational efficiency + customer quality.

- Simple Product Success – 90.4% of performers use just two product types. Complex products don’t improve performance, they reduce it.

6. Your 90-Day Growth Action Plan

- Teacher Acquisition Blitz – Partner with Ghana Education Service for direct payroll marketing to 200,000+ teachers with pre-approved offers.

- Income Verification Upgrade – Implement real-time salary verification for all government employees to capture the performance premium.

- Marriage Status Scoring – Add marital status as primary approval factor with preferential rates for married applicants.

- GHS 3K-5K Income Targeting – Focus all marketing spend on the 24.8% sweet spot income bracket with dedicated acquisition teams.

- Urban Branch Optimization – Concentrate service delivery in Accra, Tamale, Kumasi where 43.5% of performers live.

- Product Portfolio Simplification – Eliminate complex products and focus on the two types that work: non-secured and term loans.

7. The Growth Opportunities Everyone’s Missing

- Good News: You have 2.36 million customers who prove your business model works—now you need to find more like them.

- Better News: The performer profile is crystal clear—government employees, married, GHS 3K-5K income, urban locations.

- Best News: There are 200,000+ teachers in Ghana but you only have 90,112 as customers—massive untapped market with proven risk profile.

- Hidden Opportunity #1: Women represent 41% of performers but acquisition is male-skewed—female government employees are underserved profit potential.

- Hidden Opportunity #2: Performers have 10.8x larger average loans than defaulters—focus on loan size growth, not customer volume growth.

- Hidden Opportunity #3: Government payroll integration could automate approval and repayment for the entire public sector workforce.

8. The Competitive Advantages You’re Not Using

- Data Advantage: You know exactly what a good customer looks like—government employee, married, GHS 3K-5K income, urban.

- Product Advantage: Simple products (non-secured + term loans) work better than complex ones—competitors are over-engineering.

- Geographic Advantage: Urban concentration in top 3 cities creates operational efficiency and customer density advantages.

- Sector Advantage: Government employee focus provides predictable income streams and automated repayment possibilities.

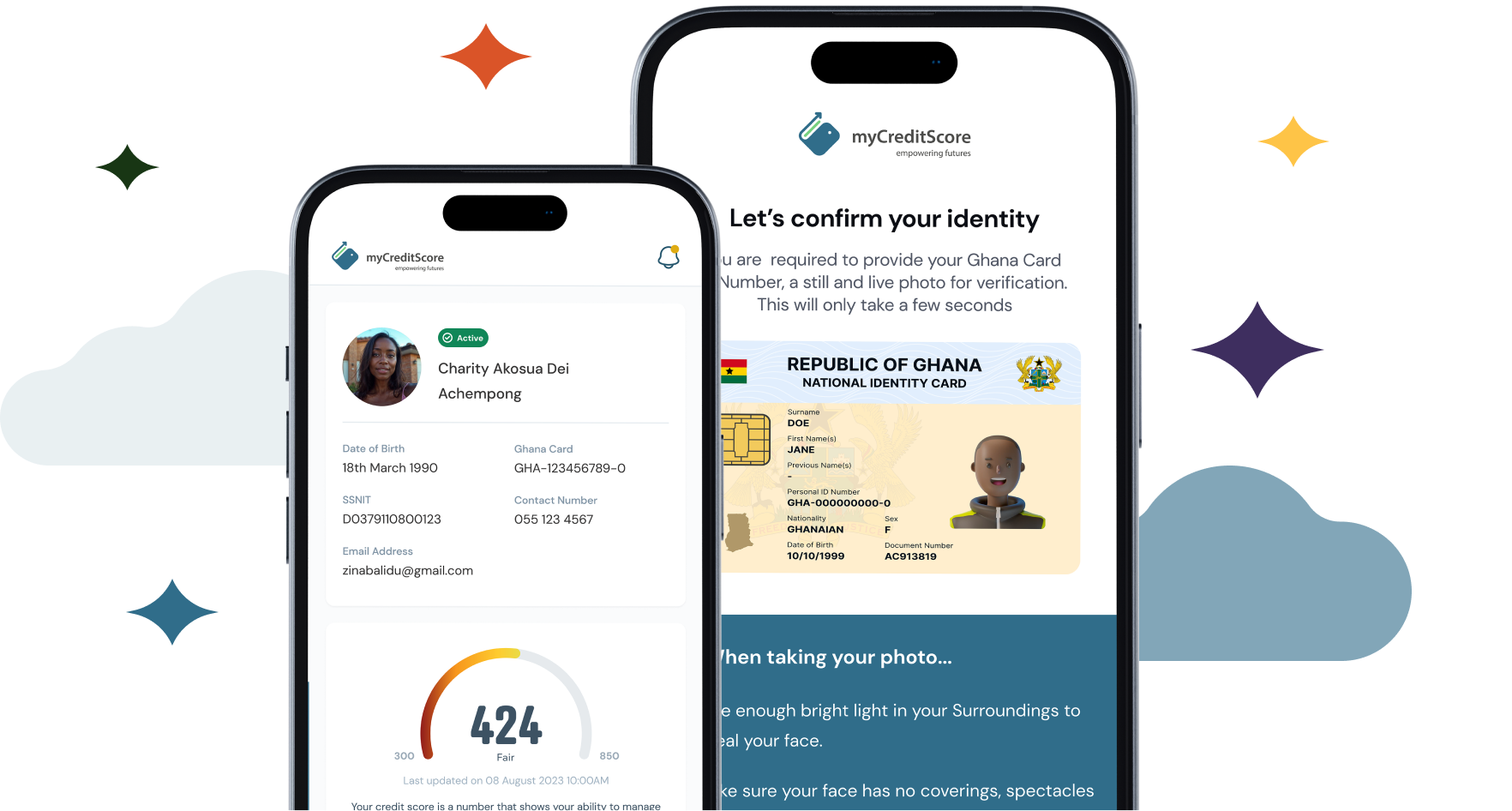

READ ALSO: The Evolution of Credit Scoring in Ghana

Bottom Line

Ghana’s credit market has 2.36 million borrowers who prove profitable lending is possible—but only if you target the right customers with the right products. The May 2025 data shows that income verification beats credit scoring, government employment beats private sector, and marriage status beats age in predicting performance.

For Growth Strategy: Stop trying to fix defaulters and start cloning performers. Teachers, government employees, married customers in the GHS 3K-5K income bracket should be 80% of your acquisition focus.

For Product Strategy: The 90.4% of performers use just two product types—non-secured and term loans. Complex products don’t improve performance or profitability.

For Market Strategy: Urban concentration isn’t a limitation—it’s an advantage. Focus on the 43.5% of performers in top cities rather than chasing rural diversification.

The real opportunity: There are 200,000+ teachers in Ghana, 500,000+ government employees, and millions of married, urban, middle-income Ghanaians who match your performer profile. The acquisition challenge isn’t finding customers—it’s finding the right customers.