How myCredit Score Is Reducing Loan Defaults in Ghana

June 18, 20253 minutes read

Lending in Ghana has become a risky business. With nearly 1 in 4 loans going unpaid, the system hasn’t exactly been working in favor of banks or borrowers.

But what if data could change that? That’s exactly what myCredit Score is doing.

Our latest analysis shows that loans assessed through the myCredit Score platform have much lower default rates than the national average.

Here’s what the data is telling us and why it matters for Ghana’s lending future.

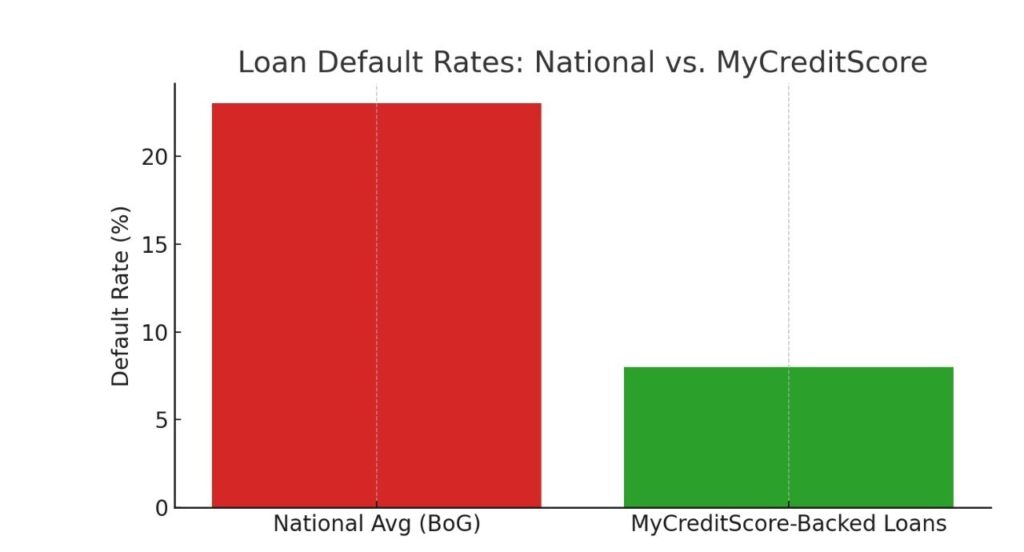

Ghana’s Credit Challenge: 23% of Loans in Ghana Are Non-Performing

According to the Bank of Ghana, 23% of loans are non-performing, meaning they’re not being paid back. These defaults cost billions, drive up interest rates, and block access to credit for people who genuinely want to repay.

It’s a cycle of mistrust. And it’s holding us back.

READ ALSO: Understanding Credit Score: The New Financial Passport to Accessing Loans in Ghana

The Breakthrough: Predictive Scoring That Works

Using a dataset of 21,000+ credit records (including over 2,000 confirmed defaulters), myCredit Score uncovered powerful patterns around who defaults and why.

So, who’s most at risk?

- Age 30–50: Makes up 62% of defaulters

- Occupations: Traders, transport workers, casual labourers

- Relationship status: Singles and divorced folks had higher default rates

- Region: 67% of defaults happen in urban areas

- Gender: Men were 1.4 times more likely to default

It’s not just random. It’s predictable.

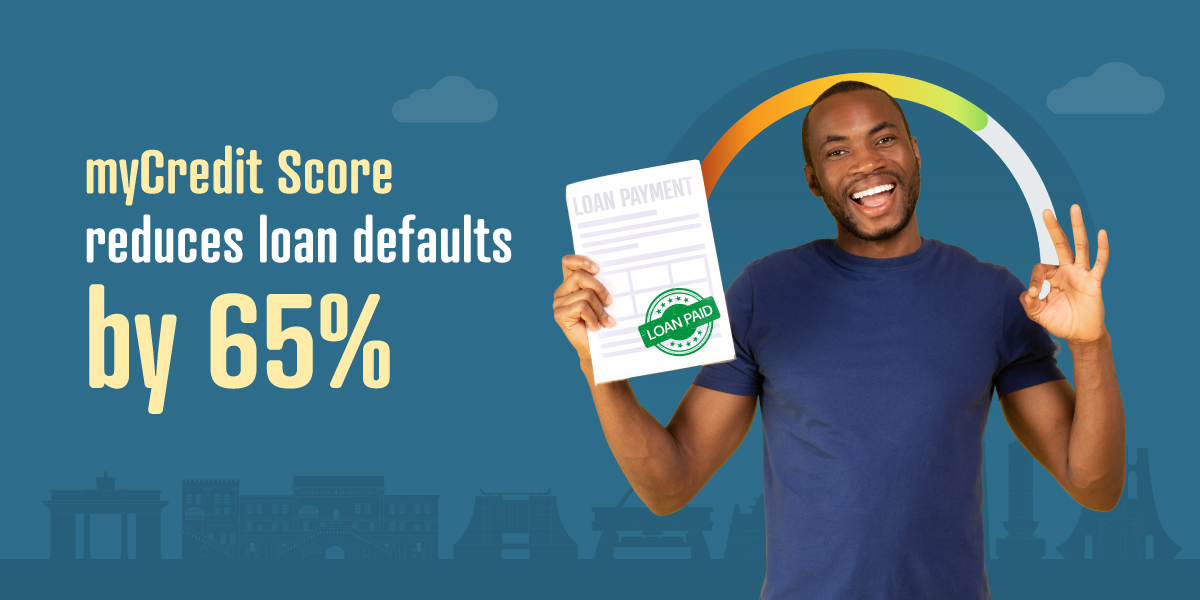

National Default Rate vs. myCredit Score-Backed Loans

Loans filtered through myCreditScore’s predictive engine see up to 65% lower default rates compared to the national average.

Default Traps: Where Borrowers Slip

The data shows most defaulters:

- Took micro-loans below GHS 25,000

- Worked in informal or seasonal jobs

- Had 3 or more active loans

- Carried a debt-to-income ratio above 45%

- Had short credit histories (often defaulting within 6 months)

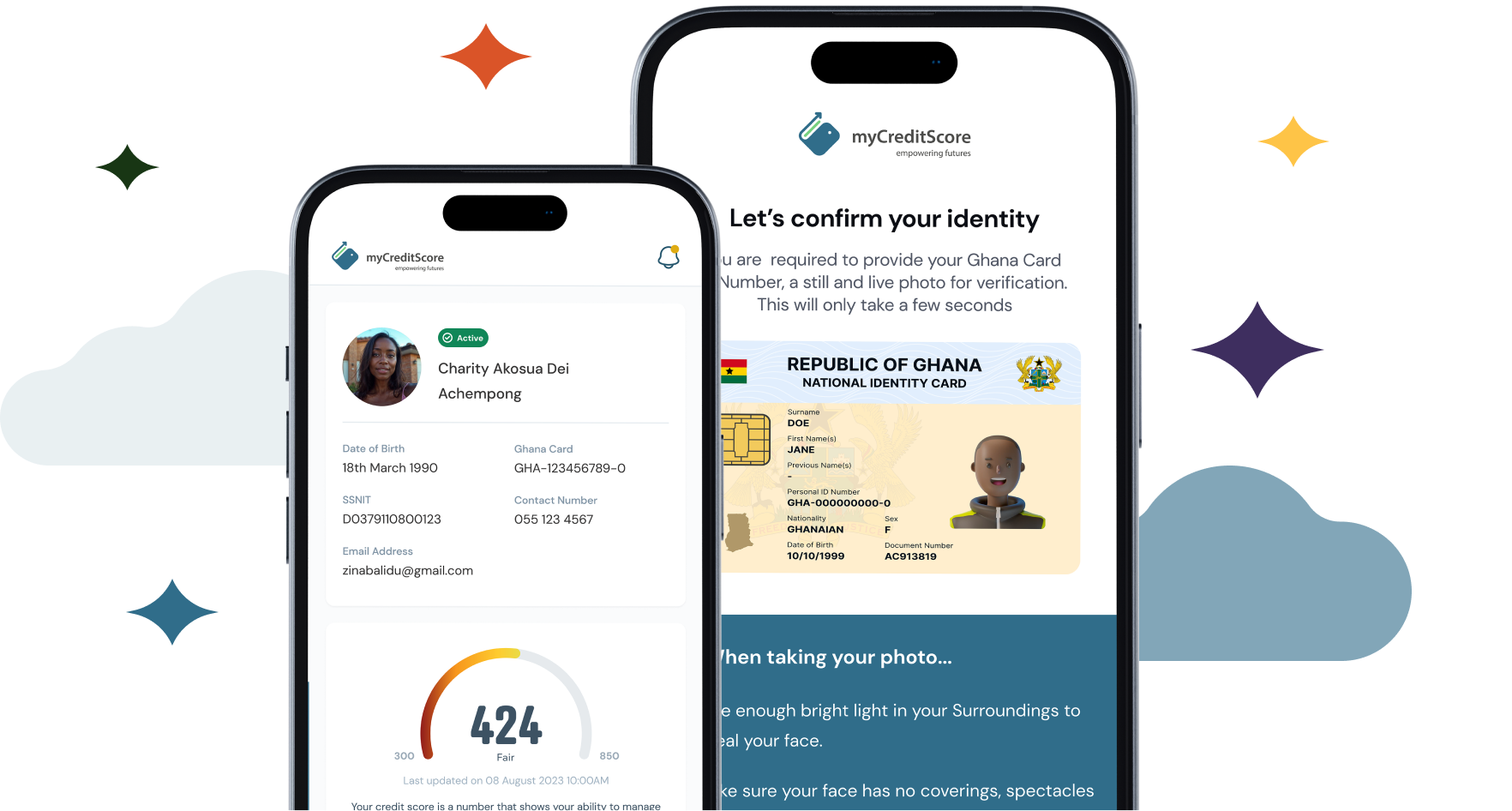

How myCredit Score Helps Lenders Make Smarter Calls

Our platform doesn’t just look at numbers. It combines:

- Demographic data (age, job, location, marital status)

- Social media and digital behaviour

- Loan repayment history

- Risk profiling and real-time scoring

Loans filtered through myCredit Score show up to 65% fewer defaults than the national average.

The Results Speak Loudly

Lenders using myCredit Score can expect:

- 25–30% drop in default rates in 6 months

- Faster loan decisions (up to 40% quicker)

- Lower operational costs, especially for smaller loans

- A more loyal and trustworthy borrower base

A Stronger Credit Culture for Ghana

As Ghana’s economy grows, credit will become a bigger part of how we trade, save, and build. But without accurate scoring, lending remains a guessing game.

That’s where data steps in.

With myCredit Score, lenders can reduce risk, expand financial access, and help create a future where credit works for the people, not against them.

If you’re in the lending space, this is your sign. The future of lending in Ghana is smart, fair, and powered by data.